Engaging with Consumers and Industry Professionals

| April 25, 2018

In Fall 2017, RECA hired Weaver Marketing Research to gather in-depth feedback from Alberta consumers and industry professionals through focus groups and surveys. This is the third time RECA has conducted this series of surveys and focus groups, and we’re beginning to see trends and changes over time. We can now compare the results of the latest research with those of past years to gauge the effectiveness of RECA initiatives, and to mark changes in industry attitudes towards RECA, trends in consumer awareness of RECA, and consumer attitudes towards the industry itself.

Overall, the results from this year’s research show an upward trend in ratings for most aspects of RECA’s performance as a regulator, but they also identified areas where RECA can improve further.

Consumers

RECA’s consumer surveys and focus groups help us understand consumer experiences within Alberta’s real estate industry and with its licensed professionals. Consumer awareness of RECA promotes a better appreciation for the professionalism and skills licensed industry professionals offer, and this awareness provides consumers with the knowledge that RECA is available to offer neutral, independent information, and guidance if they have questions or concerns.

Within this year’s consumer research, there is a lot of good news, both for RECA and for licensed industry professionals.

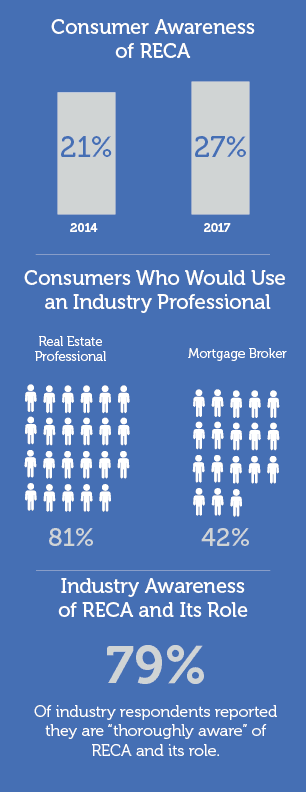

- Consumer awareness of RECA continues to grow, albeit slowly. Since the 2014 survey, awareness has grown from 21% to 27%. Consumers know an organization regulates the industry, but there remains some uncertainty about what that organization is.

- The majority of consumers surveyed in 2017 (81%) say they would use a real estate professional for their next transaction, and 42% say they would use a mortgage broker (compared to 48% who would use a bank) – this is a modest gain in favour of mortgage brokers relative to 2014.

- Consumers say that the majority of their transactions go smoothly. When consumers do express dissatisfaction, it’s mostly related to the state of the market or high commissions, rather than the services their professional provided to them.

- Consumers use multiple sources of information about their property purchase/sale through the course of their transactions.

- Consumers rely on their real estate professionals and mortgage brokers as experts to provide advice and guide them.

- Many consumers eventually remembered seeing and signing a Consumer Relationships Guide, but they felt the document’s style of language and presentation impeded their comprehension.

- Consumers more clearly recall and more positively receive the Service Agreement though some consumers were not clear on exactly when they signed.

- Consumers believe advertising is one way for RECA to get its message out.

- Consumers believes industry professionals promoting their RECA affiliation would provide a “badge of legitimacy, to instill consumer confidence.”

Industry Professionals

As with the consumer research, there was also good news in the results of the industry professional survey research.

- A vast majority of industry respondents (79%) reported they are thoroughly aware of RECA and its role.

- RECA has strengthened its position as the most important source of information about obligations under the Real Estate Act and Rules

- Opinions on RECA’s effectiveness in enforcing conduct requirements have progressed gradually upwards, and through the results we see greater agreement with the effectiveness of industry self-regulation.

- Industry professionals still see RECA excelling at setting and enforcing standards of conduct for the industry and at protecting consumers, but RECA performance remains weaker in providing services for enhancing/ improving the industry.

- Survey results showed significant improvement for every tested aspect of RECA administering the Act & Rules, with particular gains for efficient licensing, promotion of ethics and standards, and even its lowest scoring factor, consumer education & awareness, improved.

- As in past years, the strongest ratings come from mortgage brokers, new industry professionals (less than two years), those who have taken RECA Education, and professionals who recently contacted RECA staff/practice advisors. Again, as in past years, the lowest ratings came from appraisers, those with less contact with RECA, and those who were the subject of a complaint or review.

- Industry professionals indicated high levels of satisfaction with RECA’s efficient licensing process through the myRECA system

- Almost unchanged since 2014, feelings about the appropriateness of RECA’s disciplinary penalties are polarized.

- The survey also asked industry professionals what they think is the most important regulatory issue that will affect them in the next three years. The most popular answer was the Residential Measurement Standard, with transaction brokerage and “double-ending” deals coming in second.

- 2017 results produce the highest level of agreement yet with the effectiveness of industry self-regulation, with 58% now saying ‘very’ or ‘completely’ effective.

In the end, this research shows slow, but steady improvements in how consumers and industry understand, access, and perceive RECA. It’s good news for RECA – and for the strength and reputation of the industry as a whole.