Get to Know RECA: Finances and Fees

| July 31, 2023

Unless otherwise indicated, all numbers in this report are based on 2022 fiscal year-end data.

In order to fulfil RECA’s consumer protection mandate, we require revenue, which is largely obtained from our annual licensing fees. This edition of Get to Know RECA explains our financial position, answers some frequently asked questions, and explains details regarding RECA’s revenue, expenses, and fees.

Established in 1996, the Real Estate Council of Alberta (RECA) is the independent governing authority that sets, regulates, and enforces standards for real estate brokerage, mortgage brokerage, property management and condominium management licensees, in order to protect members of the public who use their services. Alberta is one of only a few jurisdictions in North America with a fully self-regulated real estate industry.

At RECA, we are committed to transparency in the public interest, and rely heavily on stakeholder input. Our central mandate is to protect Alberta consumers, and to protect against, investigate, detect, and suppress fraud as it relates to the business of our licensees. Transparency in our processes allows the Government of Alberta, the public (consumers), and licensees to determine if we are, in fact, an independent and accountable regulatory body fulfilling our mandate in a manner intended by the legislation.

HOW THE MONEY FLOWS

Our proposed budget is reviewed and amended by our Finance and Audit Committee, which is made up of Board members appointed by the Board. The final budget is brought to the Board for approval and then currently reviewed by the Minister of Service Alberta and Red Tape Reduction for final approval.

Please refer to RECA’s year-end Financial Statements for a full, up-to-date look at our financial position.

Where the Money Comes From

Licensing Fees

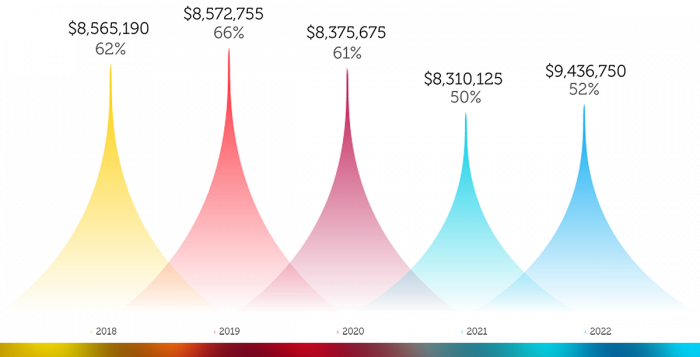

The largest portion of our revenue, by far, comes from the fees licensees pay annually.

All RECA licence fees are due each year by our fiscal year-end deadline on September 30. This creates the largest cash balance, as reported in the year-end financial statements. It is important to note that the licence fee revenue is not reoccurring and this annual (one-time) source of revenue is drawn down throughout the next fiscal year, and must be prudently managed.

This is a different fee process than some other jurisdictions which operate on a rolling renewal system, providing revenue from licence renewal fees throughout the entire year.

Other Income in 2022

Prior to December 1, 2022, RECA received revenue from the delivery of licensing education. This accounted for 39% of RECA’s revenue in 2021–2022. As of December 1, 2022, RECA divested from the delivery of all licensing education, and now relies on third-party course providers. RECA no longer receives any revenues from the delivery of licensing education.

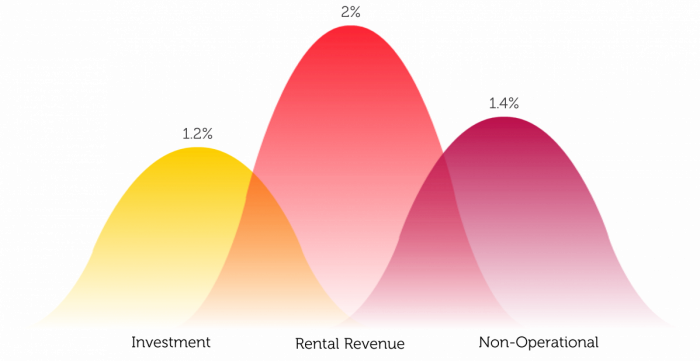

- investment income: bank interest and interest on short-term investments

- rental revenue: income from RECA office building tenants

- non-operational revenue: fines,* penalties, and hearing costs recoveries

*fines are charged to those found to be in violation of the Real Estate Act, Rules, Regulations, or Bylaws.

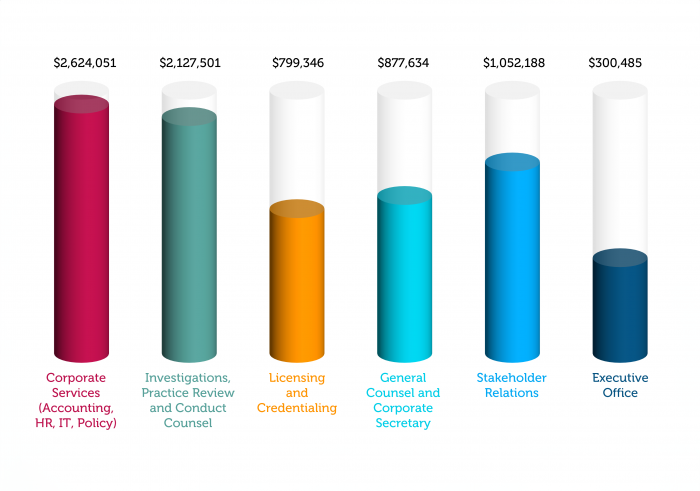

What the Money Goes Towards

RECA Team

The largest portion of RECA’s operating revenue goes towards the salaries and benefits of our employees. RECA requires capable and professional staff in order to fulfil its mandate.

The RECA team is responsible for managing complaints, hearings, disciplinary reviews, suspensions, as well as industry and consumer education and awareness.

Professional Services

The Professional Services line item on RECA’s Financial Statements is largely made up of the legal costs required for court action brought against RECA. This expense has been exceptionally high, as we have been facing multiple and ongoing lawsuits since 2019 on matters that are unrelated to consumer protection or licensee livelihoods.

We expect to be successful in our defense on all matters; however, the resources required for outside counsel and for the time of our senior staff are exceptional and are a considerable burden.

Capital Assets

A portion of our expenditures goes towards investments in capital assets (IT hardware, office, etc.).

What Stakeholders Really Want to Know

What does RECA do with Excess Revenue

As a not-for-profit, if we generate revenue that exceeds our expenses in a fiscal year, a portion of the excess revenue over expenses can be contributed to an internally restricted general reserve at the recommendation of the Finance and Audit Committee, and with the approval of the Board. The general reserve serves to ensure the stability of the mission, programs, employment, and ongoing operations of the organization.

It is normal business practice to have at least 6-18 months of operating expenses in reserve.

As reported, on September 30, 2022, we had $9,484,500 in our General Reserve, which amounts to approximately 9 months of operating expenses.

How does RECA Plan to Achieve its Mandate with the Loss of Education Revenue?

RECA has undergone operational efficiency projects over the past several years in preparation for the loss of education revenue. This included reducing our core complement and undertaking a complete operational process review in search of efficiencies, all without lowering the level of protection RECA is mandated to provide Alberta consumers.

The Board takes its role in setting our budget seriously, and will only ever increase licence fees when it is absolutely necessary to do so for us to adequately fulfill our consumer protection mandate.

Also, an increase in the cumulative number of licensees entering the industry in recent years has attributed to a larger than average revenue stream from license fees which, if continued, could help assist in offsetting the loss of education revenue.